Visualising Pacific government budgets

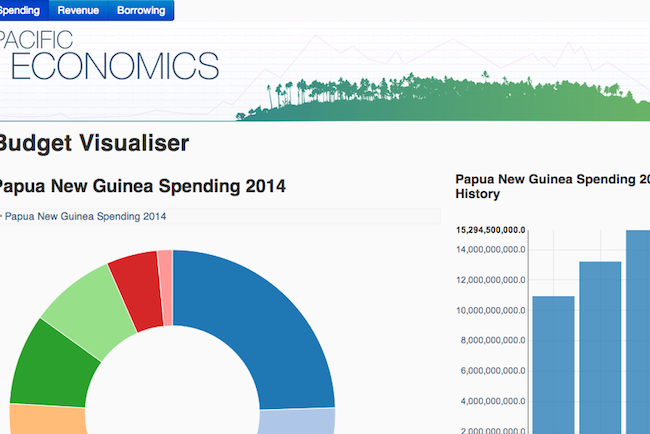

PiPP is proud to announce the launching of Pacific Economics, a site devoted to better understanding of financial, fiscal, business and trade issues in the Pacific islands. Our inaugural offering is a visualisation of the 2014 PNG Budget. This is part of a broader effort, beginning in early 2014, to promote engagement in the budget-making process and to encourage discussion concerning the delivery and funding of public services.

Explore our first version of the visualisation. Click your way down from national budget elements to individual programmes. We will soon be adding new features and providing more information, and are also already in discussions with other governments to access their budget data as well. In the meantime, dive in, and feel free to send any comments or questions our way:

About the PNG budget

At the end of 2012 the government of Papua New Guinea presented an ambitious budget that offered rapid growth in spending and doubled contributions to their key ‘enablers’ for development – education, health, infrastructure, law & order, and land. As a result, 2013 saw resources directed toward subsidies for healthcare charges and school tuition fees, investment in infrastructure and devolved spending to districts and local level governments. These commitments opened up a sizeable budget deficit that was expected to spur economic activity and bridge the gap left between the winding down in LNG construction and the start of LNG production expected in 2014.

The 2014 Budget, passed in November, perhaps does not offer the same level of headline grabbing changes of last year, however it builds firmly on previous commitments and does offer a number of new spending pledges. As the government highlights, in 2014 further resources will be channeled towards such areas as road construction and maintenance, investment in tertiary education and hospital redevelopment. Other spending commitments can also be seen in our visualisation of the budget, such as the creation of a Special Economic Zone in the Sepik Plains and investment in the People’s Microbank, while spending obligations continue to come from the Alotau Accord – the agreement that fell out of the political settlement of 2012 – such as a significant contribution to Identity Cards and funding of the 2015 Pacific Games.

Although the government plans for a slightly smaller deficit in 2014, placing the government on the path towards reducing the budget shortfall, the PNG government has come close to the limits of its own rules for fiscal responsibility. Indeed, an amendment to the Fiscal Responsibility Act was required with Debt/GDP very close to breaching their 35 percent limit. Yet to walk this tightrope of responsibility, the government has been searching determinedly for revenues to fill the gap. This largely has not come in the form of new taxes or rapid increases in economic activity, instead the government has found as much as PGK 1 billion in efficiency savings and from compliance measures in 2014. To give scale to these adjustments, in their absence the deficit would be close to PGK 800 million more than in 2013 and debt/GDP would move closer to 38% – well above the government’s own limits. This is not to say that these estimates are incorrect, more to say there is reason to be cautious.

In any case, in 2014 the PNG government looks to concessional financing to fund an increasing proportion of the budget shortfall. As PiPP has highlighted before such lending does not come without risks. At the same time, domestic opportunities for borrowing appear to be limited, given the extent that the central bank has stepped in to finance the 2013 deficit. If the deficit creeps higher than expected we may see more pressure on the central bank to pick up any shortfall, which is likely to be a cause of concern, particularly if it places further pressure on a weakening Kina.

As with previous years some of the most pressing challenges facing the PNG government are likely to revolve around ensuring the budget is implemented as planned:

Delivering the budget: similar to governments across the region, in some areas of spending is difficult to control, while in other areas, such as in delivering infrastructure projects, it can be equally difficult to get the money out the door. This is particularly true when spending is scaled up as rapidly as in PNG. Evidence for this has already been seen in 2013, however 2014 may be an even bigger test for the Treasury.

Finding improvements in public services: broadening the benefits of a resource boom requires improving public financial management systems and delivery of public services. At the lower levels of government weak capacity and governance arrangements means that extra resources may struggle to make their way to the right places and deliver the expected outcomes. This is an issue that the PNG government and partners continue to grapple with.

Looking ahead: from this budget onwards the PNG government has planned to hit hard on the spending brakes and will be looking for real cuts in spending from the next budget onwards. Yet the ability for the government to pull spending growth from an average of 17% in 2013 and 2014 to 3% over 2015 and 2016 in an environment where revenue is performing relatively well is a challenge for most countries, particularly as they move closer to elections.

Similar to last year, potential solutions to these challenges are likely to dominate the discussions around the PNG budget. The latest picture of the economy painted by the budget is of rapid economic growth driven by oil and gas extraction that transforms PNG into an exporting economy. However, the outlook for other important sectors, such as agricultural, fisheries and forestry remains worryingly flat. Here remains a central concern facing the PNG government – and governments across the region – of how to strengthen public service delivery and broaden the benefits of this economic growth.

The PNG 2014 Budget remains ambitious with the aim of transforming public services and offering up financial management reforms. However the ability to transform these into the outcomes they are searching for, while holding on to fiscal responsibility, will undoubtedly be the topic of much discussion over coming months.